I know this is not what you were looking for business insights group

Table of Contents

Table of Contents

Understanding a company’s financial status is crucial in any decision-making process, especially when investing or partnering with a business. Reading a financial report statement may sound daunting, but it is a vital skill that every investor or business owner should learn. In this article, we will delve deeper into read company financial’s report statement and how it can benefit you.

Pain Points in Understanding Financial Reports

Many people find financial reports intimidating because they are often filled with technical jargon and complex calculations. Additionally, they can be extremely lengthy and require a basic knowledge of accounting principles to comprehend. Oftentimes, individuals are unsure of what to look for or which sections of the report are most essential. This is where read company financial’s report statement can come in handy.

Answering the Target of Financial Reports

Read company financial’s report statement refers to the process of analyzing a company’s financial performance by examining its annual or quarterly reports. It entails an in-depth examination of the company’s income statement, balance sheet, and cash flow statement to assess its financial health, profitability, and liquidity.

Summary of the Main Points

Reading a financial report statement may seem daunting at first, but it is a crucial skill in the world of business. Understanding the pain points in understanding these reports is the first step in developing a better understanding of read company financial’s report statement. This process involves examining a company’s financial performance, including its income statement, balance sheet, and cash flow statement. By doing so, investors and business owners can assess the financial health, profitability, and liquidity of a company.

Personal Experience with Reading Financial Reports

As an entrepreneur, I have learned that it is essential to understand a company’s financial status before venturing into any business partnership. In my early days, I found financial reports overwhelming and relied on others to help me decipher them. However, after taking some time to educate myself on read company financial’s report statement, I was able to confidently analyze a company’s financial performance and make informed business decisions.

One of the most important things I have learned is that every section of the report is crucial to understanding a company’s financial health. For example, the income statement provides a clear picture of a company’s revenue and expenses, while the balance sheet illustrates the company’s financial position at a specific point in time. The cash flow statement, on the other hand, shows how cash flows in and out of the business.

Benefits of Reading Financial Reports

There are many benefits of read company financial’s report statement, including:

- Understanding a company’s financial health and profitability

- Gaining insight into a company’s liquidity and ability to pay off debts

- Identifying potential red flags or warning signs that a company may be struggling financially

- Comparing a company’s financial performance to its competitors or industry standards

The Importance of Analyzing Financial Ratios

One of the most useful tools for analyzing financial reports is calculating financial ratios. These ratios provide a way to compare a company’s financial performance to industry benchmarks or to its own past performance. Some of the most common financial ratios include:

- Liquidity ratios

- Profitability ratios

- Solvency ratios

- Efficiency ratios

Understanding Liquidity Ratios

Liquidity ratios are used to measure a company’s ability to meet its short-term obligations. The most common liquidity ratios are the current ratio and the quick ratio. The current ratio is calculated by dividing current assets by current liabilities, while the quick ratio is calculated by subtracting inventory from current assets and dividing by current liabilities.

How to Improve Your Financial Analysis Skills

If reading financial reports is still daunting, there are ways to improve your financial analysis skills. One way is to take a basic accounting course or to seek advice from a financial advisor. There are also many online resources available, such as YouTube tutorials or webinars, that can provide a more in-depth understanding of read company financial’s report statement. Remember, the more you educate yourself on financial reports and analysis, the more confident you will be in your ability to make informed business decisions.

Question and Answer

Q: Why is it important to read a company’s financial report?

A: Reading a company’s financial report provides insight into its financial health, profitability, and liquidity. It can help identify potential red flags, compare a company’s performance to industry standards or competitors, and aid in making informed business decisions.

Q: What are some common financial ratios used in analyzing company financial reports?

A: Common financial ratios include liquidity ratios, profitability ratios, solvency ratios, and efficiency ratios.

Q: Are there any resources available to help individuals better understand financial reports?

A: Yes, there are many online resources, such as YouTube tutorials or webinars, that can provide a more in-depth understanding of read company financial’s report statement. Additionally, taking a basic accounting course or seeking advice from a financial advisor can also be beneficial.

Q: What is the benefit of analyzing financial ratios?

A: Analyzing financial ratios provides a way to compare a company’s financial performance to industry benchmarks or to its own past performance. It can help identify areas of strength or weakness and aid in making informed business decisions.

Conclusion of Read Company Financial’s Report Statement

Reading financial reports may seem intimidating at first, but it is an essential skill for any investor or business owner. By understanding read company financial’s report statement, individuals can gain valuable insight into a company’s financial health, profitability, and liquidity. Additionally, analyzing financial ratios can provide a more in-depth analysis of a company’s financial performance. The key to mastering financial analysis is education, so don’t be afraid to seek out resources and advice to improve your skills.

Gallery

How To Read Financial Statements Of A Company? | Financial Statements

Photo Credit by: bing.com / financial basics arising unemployment tradebrains

Pin On Report Templates

Photo Credit by: bing.com / stableshvf

I Know This Is Not What You Were Looking For! – Business Insights Group

Photo Credit by: bing.com / insights servicios financials organizados

How To Read Financial Statements Of A Company? | Financial Statement

Photo Credit by: bing.com / statements dividends tradebrains brains

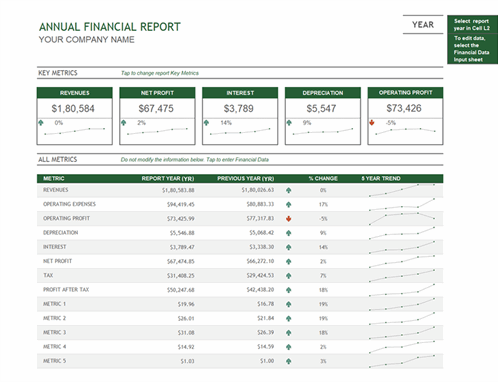

Annual Financial Report

Photo Credit by: bing.com /