Roth ira contribution limits does work magnified backdoor magnifying glass ultimate guide tsp istock rollovers distributions conversion december fedsmith differences

Table of Contents

Table of Contents

Are you considering opening a Roth IRA account, but not quite sure what it entails? If so, you’re not alone. Many people have heard of the term “Roth IRA”, but aren’t quite sure what it is and how it works. In this article, we will explore the ins and outs of Roth IRA and answer the question “how does Roth IRA work?”. By the end of this article, you will have a better understanding of whether a Roth IRA account is right for you.

Pain Points Related to How Does Roth IRA Work

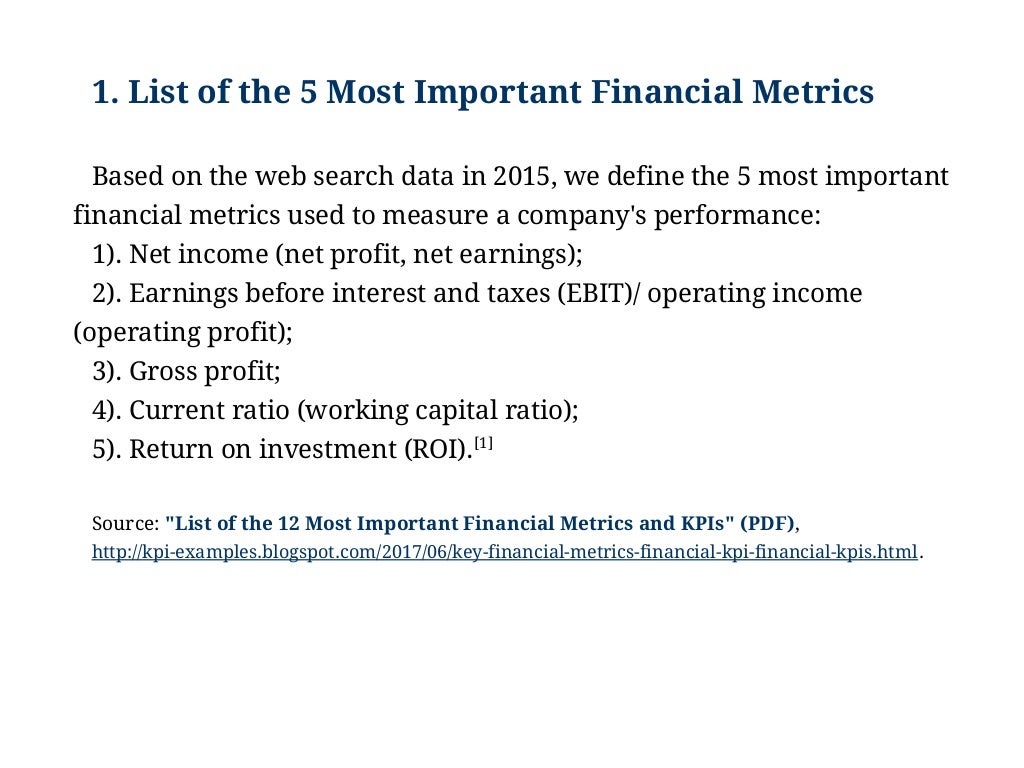

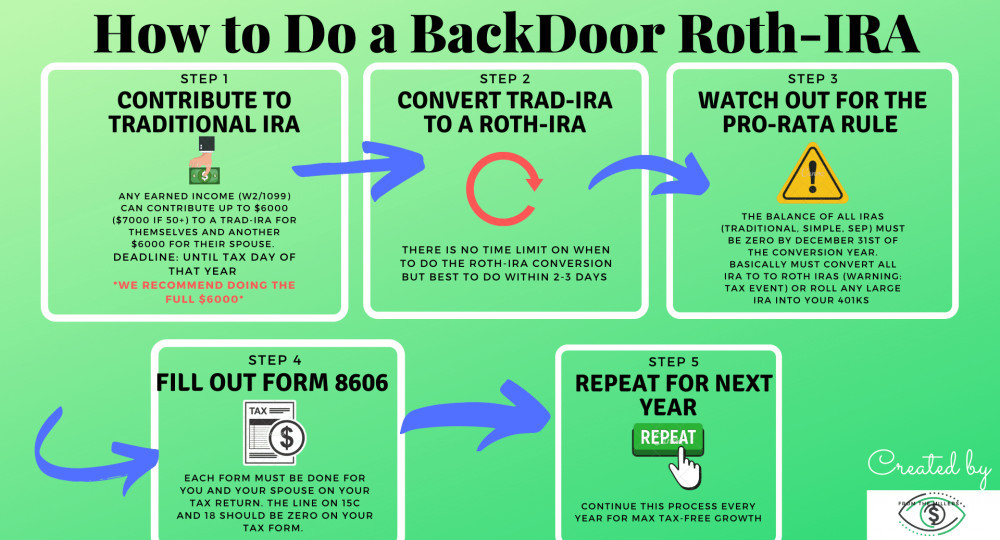

Retirement can be a daunting topic, and understandably so. According to the National Institute on Retirement Security, the median retirement account balance among working-age Americans is $0. This fact alone can cause a great deal of anxiety for those approaching retirement age. However, with the proper knowledge and planning, retirement can be a time of relaxation and enjoyment. One way to ensure a comfortable retirement is by opening a Roth IRA account. While it may seem complex, opening this type of account can offer many benefits, such as tax-free withdrawals during retirement, higher contribution limits, and no Required Minimum Distributions (RMDs) during your lifetime.

Answer to How Does Roth IRA Work

In short, a Roth IRA is a retirement savings account that’s funded with after-tax dollars. Contributions to the account are not tax-deductible, but both contributions and earnings can grow tax-free. The biggest advantage of Roth IRA is that all qualified withdrawals, including earnings, are tax-free. To be eligible to open a Roth IRA account, you must have earned income and your Modified Adjusted Gross Income (MAGI) should be less than $140,000 if you’re single or $208,000 if you’re married filing jointly.

Summary of Main Points Related to How Does Roth IRA Work

Opening a Roth IRA account can offer many benefits, such as tax-free withdrawals during retirement, higher contribution limits, and no Required Minimum Distributions (RMDs) during your lifetime. To be eligible to open a Roth IRA account, you must have earned income and your Modified Adjusted Gross Income (MAGI) should be less than $140,000 if you’re single or $208,000 if you’re married filing jointly.

How Does Roth IRA Work: Targeted Explanation

As a recent college graduate, I had little knowledge about the importance of retirement savings. However, after researching my retirement options, I decided to open a Roth IRA account. I remember feeling a bit overwhelmed at first, but the process was easier than I thought. What I appreciate most about having a Roth IRA is the peace of mind that comes with knowing my savings are growing tax-free. To open a Roth IRA account, start by researching various fund providers, assess your retirement goals, and determine your contribution amounts. Remember, the earlier you start saving for retirement, the more secure your financial future will be.

How Does Roth IRA Work: Common Misconceptions

One common misconception about Roth IRA accounts is that they are only available to those with high incomes. However, as we mentioned earlier, Roth IRA accounts are available to anyone with earned income, regardless of their income level. Additionally, some individuals may believe that opening a Roth IRA account is difficult or requires a large lump sum of money. However, this is not the case. Many fund providers allow you to start with a low minimum investment and make monthly contributions at your convenience.

How Does Roth IRA Work: Diving Deeper

Roth IRA accounts have a lot of advantages, but they also have some disadvantages. For example, contributions to Roth IRA accounts are not tax-deductible, which means you won’t receive an immediate tax break for your contributions. Additionally, if you choose to withdraw money from your Roth IRA account before age 59.5, you will be subject to a 10% early withdrawal penalty, unless the money is used for a qualified expense like buying your first home or paying for education expenses. It’s important to have a comprehensive understanding of both the advantages and disadvantages of Roth IRA accounts before opening one.

How Does Roth IRA Work: Maximizing Your Savings

If you’re looking to maximize your savings through Roth IRA accounts, consider taking advantage of catch-up contributions. For individuals aged 50 or older, catch-up contributions allow you to contribute an additional $1,000 per year to your Roth IRA account. Additionally, some employers may offer a Roth 401(k) retirement plan, which combines the tax advantages of a Roth IRA with the flexibility and convenience of a 401(k) plan.

Question and Answer: How Does Roth IRA Work?

Q: Can I contribute to a Roth IRA if I’m retired?

A: As long as you have earned income, you can contribute to a Roth IRA account, regardless of your age. However, Roth IRA accounts do have an income limit, so be sure to check to make sure you qualify.

Q: What happens to my Roth IRA account when I die?

A: After you pass away, your beneficiaries can inherit your Roth IRA account tax-free. Your beneficiaries can either withdraw the funds or continue to let the money grow tax-free until they withdraw it.

Q: Can I contribute to both a traditional and Roth IRA account?

A: Yes, you can contribute to both a traditional and Roth IRA account in the same year as long as your total contributions to both accounts don’t exceed the contribution limit.

Q: Will I still have to pay taxes on my Roth IRA account in retirement?

A: No, qualified withdrawals from your Roth IRA account are tax-free.

Conclusion of How Does Roth IRA Work

As you can see, opening a Roth IRA account has many benefits and can help alleviate some of the stress associated with retirement planning. To get started, research various fund providers, assess your retirement goals, and determine your contribution amounts. Remember, the earlier you start saving for retirement, the more secure your financial future will be.

Gallery

What Is A Roth IRA And Do You Really Need One? - Adopting A Lifestyle

Photo Credit by: bing.com / roth ira investing adopting fidelity adoption

How Does A Roth IRA Work: The Ultimate Guide | SaveYourDollars.com

Photo Credit by: bing.com / roth ira contribution limits does work magnified backdoor magnifying glass ultimate guide tsp istock rollovers distributions conversion december fedsmith differences

First Time Home Buyer Exemption Roth Ira

Photo Credit by: bing.com / roth ira exemption

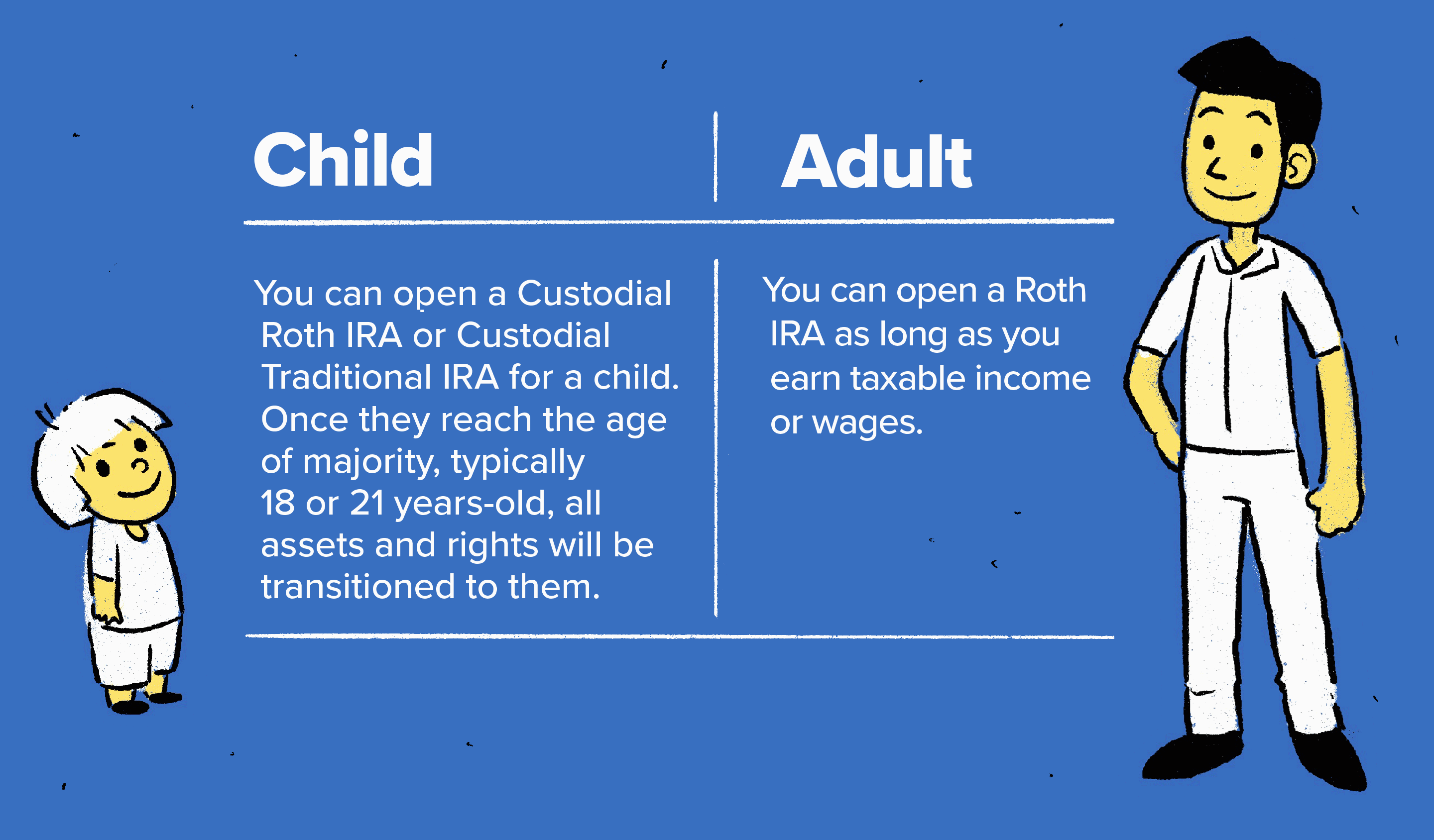

What Is A Backdoor Roth IRA? How Does It Work In 2021? | Personal

Photo Credit by: bing.com / roth ira backdoor tax iras deposits remember

How Does A Roth IRA Work? Roth IRA Explained. - YouTube

Photo Credit by: bing.com / roth ira explained