Financial statements metrics value print basic rhino balanced line freeart

Table of Contents

Table of Contents

If you’re looking to invest in stocks, you know how overwhelming it can be to choose which one to invest in. One of the most significant factors to consider is the financial health of the companies you’re considering. One way to evaluate this is through financial metrics. In this article, we’ll discuss the best financial metrics to evaluate stocks.

Investing in stocks can be nerve-wracking, especially when you’re not sure which metrics to pay attention to. It can be challenging to determine the best financial metric to evaluate a company’s health, leading to indecision and missed opportunities.

The target of evaluating financial metrics is to analyze a company’s financial health, performance, and stability. By doing so, you’ll be able to determine better whether the company is a good fit for your investment portfolio.

In summary, the best financial metrics to evaluate stocks include price-to-earnings ratio, price-to-book ratio, earnings per share, dividend yield, and market capitalization.

Price-to-Earnings Ratio

The price-to-earnings ratio (P/E ratio) is a financial metric used to measure a company’s stock price compared to its earnings. It is calculated by dividing the current stock price by the company’s earnings per share. A high P/E ratio could indicate that a company’s stock is overvalued.

Price-to-Book Ratio

Price-to-Book Ratio

The price-to-book (P/B) ratio is another financial metric used to evaluate stocks. It measures the stock price compared to its book value, which is calculated by subtracting liabilities from assets. A low P/B ratio indicates potential undervaluation.

### Earnings per Share

### Earnings per Share

Earnings per share (EPS) is the portion of a company’s profits that is allocated to each outstanding share of its common stock. It is an essential financial metric in evaluating a company’s profitability over time.

#### Dividend Yield

#### Dividend Yield

Dividend yield measures how much a company pays out in dividends relative to its stock price. It is calculated by dividing the annual dividend payment by the stock price. This financial metric is significant in evaluating companies that pay regular dividends.

Conclusion of Best Financial Metrics to Evaluate Stocks

Conclusion of Best Financial Metrics to Evaluate Stocks

Investing in stocks can be overwhelming, but by evaluating financial metrics, you can make more informed decisions about which companies to invest in. Paying attention to metrics like the price-to-earnings ratio, price-to-book ratio, earnings per share, dividend yield, and market capitalization can help you identify companies that are financially healthy, stable, and a good fit for your investment goals.

Gallery

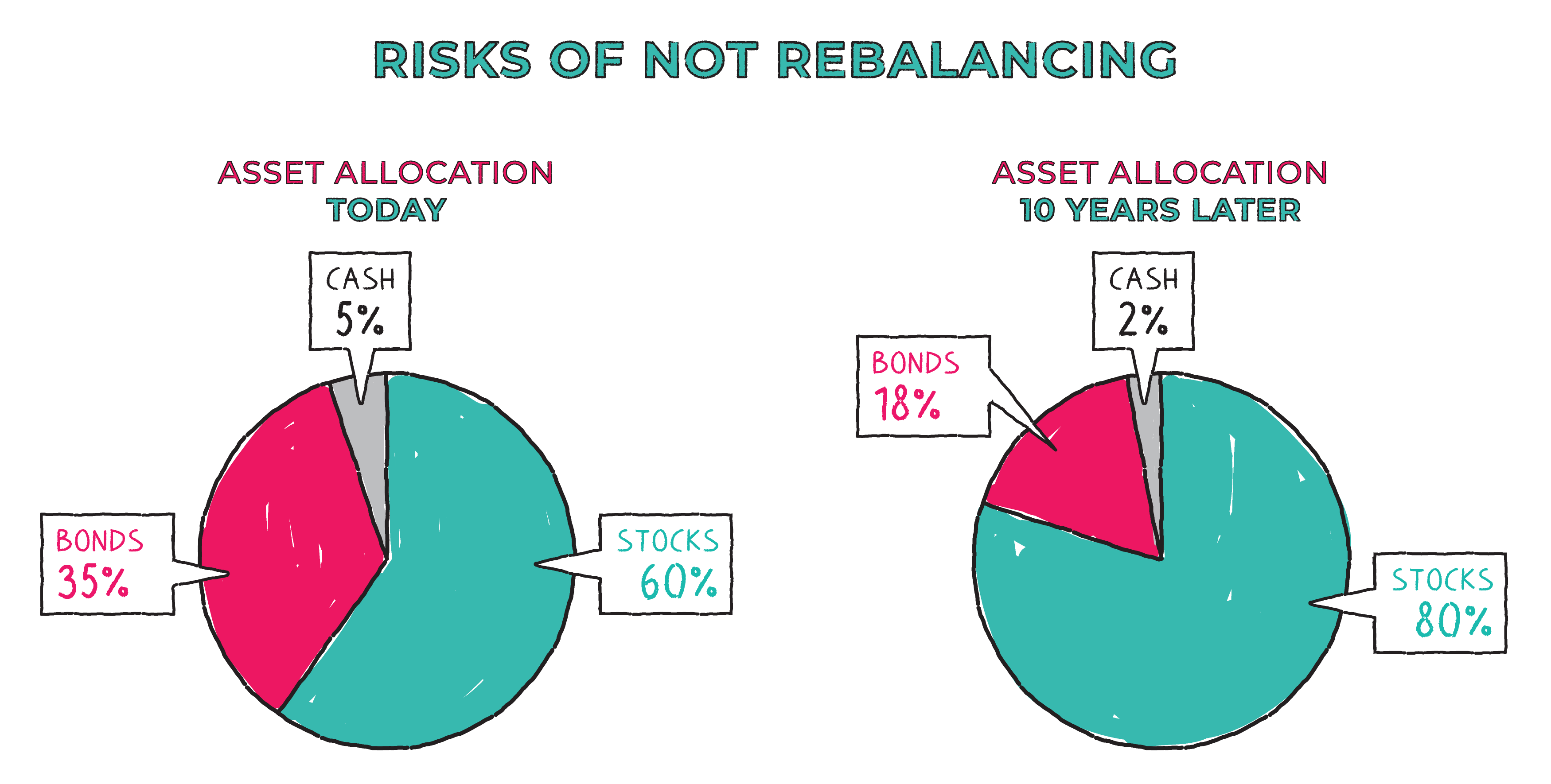

What Does Rebalancing A Portfolio Mean? Why Does Rebalancing Matter?

Photo Credit by: bing.com / rebalancing portfolio rebalance

SaaS Metrics Guide To SaaS Financial Performance | Saas, Metric

Photo Credit by: bing.com / metrics saas financial performance pdf finance guide flow customer lifetime value sheet business process metric churn various choose board chart

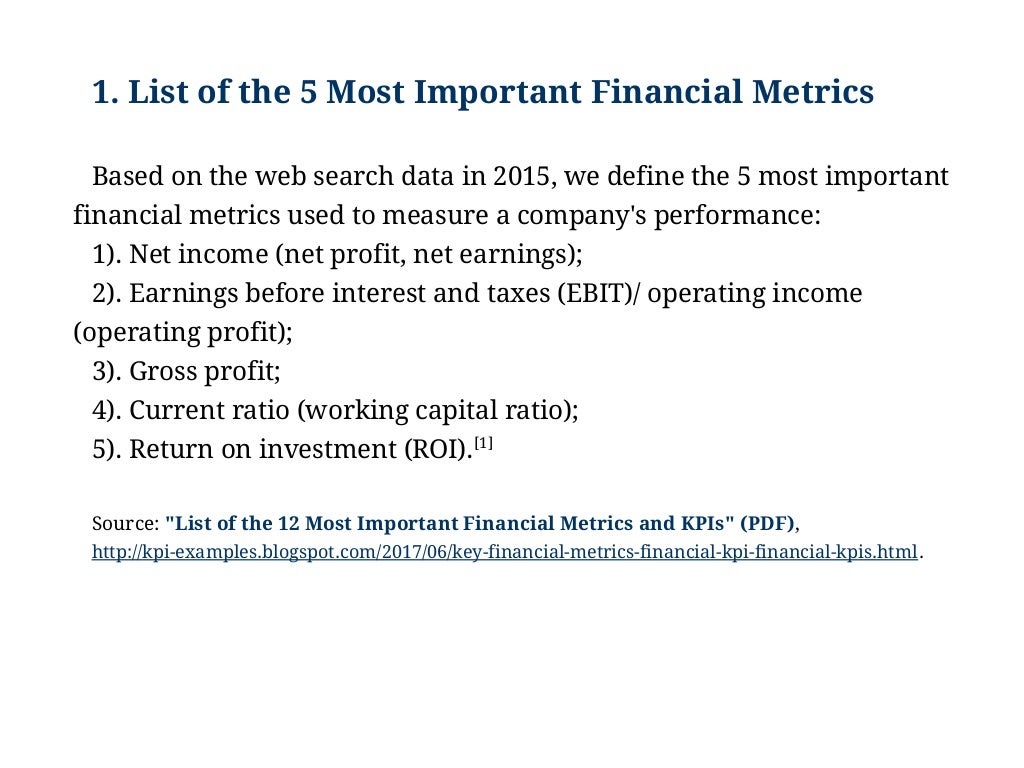

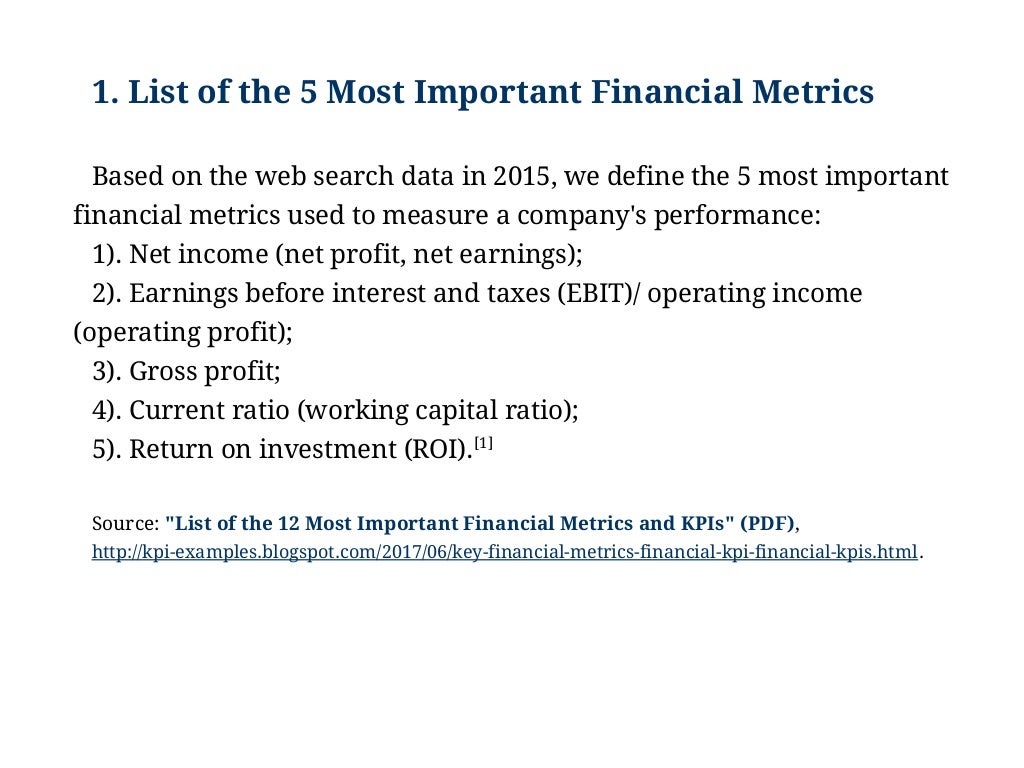

List Of The Most Important Financial Metrics: Examples Of Key Financial

Photo Credit by: bing.com / metrics metric kpi ratios

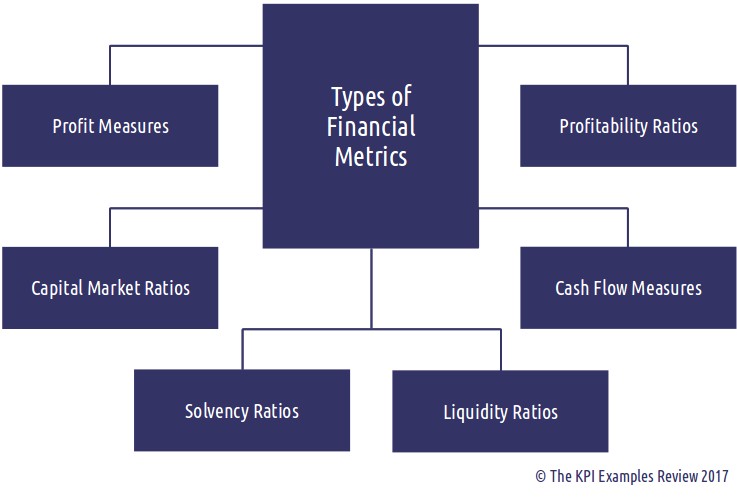

11 Basic Financial Metrics To Value A Stock - FinzWatch

Photo Credit by: bing.com / financial statements metrics value print basic rhino balanced line freeart

Examples Of The Most Important Financial Metrics: Examples Of Key Fin…

Photo Credit by: bing.com / metrics indicators